Everything You Need to Know About Hindu Undivided Families (HUF)

A Comprehensive Guide

HUF stands for Hindu Undivided Family. The main purpose of establishing an HUF is to keep the business within the family. By creating a family unit and pooling assets to form an HUF, you can achieve tax savings. An "undivided family" signifies that the family's property is collectively shared rather than divided among individual members.

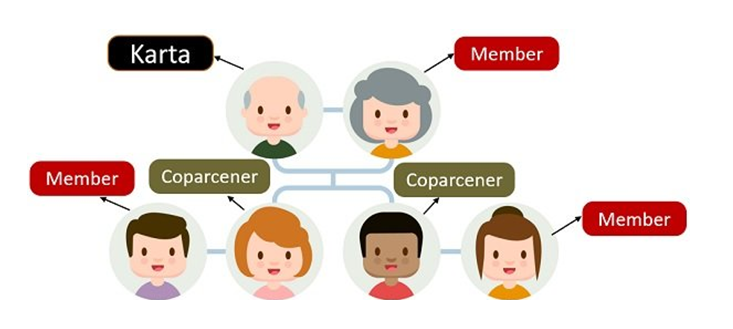

The HUF has a leader called the "Karta," who is the oldest male in the family and manages the family's business. The male descendants are called "Coparceners," and the Karta's wife and the sons' wives are called "Members." Coparceners have the right to inherit the family's property. Only a coparcener can ask for the family's property to be divided.

The Karta is the head of the Hindu Undivided Family (HUF) and is the senior-most male member. The Karta has the authority to manage the family and its property, including making decisions on property disposal if needed.

If the Karta passes away, the next senior member or the eldest child takes over. If they decline, the next eldest member or the second child can become the Karta.

Objective of HUF

A Hindu family can create an HUF to take advantage of additional income tax benefits. This is on top of the tax benefits each individual family member already gets. Although Hindu Law does not regulate Jain, Sikh, and Buddhist families, they can also create an HUF.

Taxability of HUF

The HUF has its own PAN (Permanent Account Number), HUF deed, and bank account. Income tax returns are filed separately for the HUF. Here are the benefits of an HUF:

- An HUF is taxed at the same rates as an individual.

- The HUF can take out insurance policies for its members.

The HUF can claim deductions under section 80 and other exemptions in its income tax return.

- Investments can be made from the HUF’s income, and any dividends, interest, or other income from these investments are taxable by the HUF.

- The HUF can pay salaries to its members, and these salary expenses are deductible from the HUF's income.

Important Points about HUF

1. An HUF can consist solely of female members, such as a Hindu widow and her unmarried daughter.

2. An adopted child of a coparcener can become a member of an HUF.

3. The members of the HUF must sign a declaration authorizing the Karta to manage the HUF.

4. Each family member can contribute a portion of their income to the HUF's corpus.

5. A daughter can remain a coparcener in her father's HUF even after marriage, regardless of being a member of her husband's family HUF.

6. If a person converts to Islam or Christianity, they cease to be a member of the HUF.

7. Membership in a Hindu Undivided Family is acquired by birth.

Benefits of making a HUF

- 1. Income Tax Benefits :HUF is recognized as a separate entity under Income Tax laws. Each family member has their own PAN card, and the HUF has a separate PAN card. An HUF can run its own business and invest in shares and mutual funds. It enjoys a basic tax exemption of Rs 2.5 lakh, providing significant tax benefits in addition to individual deductions and exemptions.

- 2. Owning a house : If an HUF has more than one self-occupied property, only one can be treated as self-occupied; the rest are considered 'deemed to be let out,' and tax must be paid on notional rent. An HUF can own a residential house without paying tax. Additionally, it can claim benefits under Section 80C for home loan repayments up to Rs 1.5 lakh and under Section 24 for interest up to Rs 2 lakh.

- 3. Investments : As a separate entity, an HUF can claim various income tax benefits. It can invest in Fixed Deposits (5 years or more) and Equity Linked Savings Schemes (ELSS) to get tax benefits up to Rs 1.5 lakh under Section 80C. Although an HUF cannot open a Public Provident Fund (PPF) account, it can claim tax deductions for amounts deposited in the PPF accounts of its members.

- 4. Life Insurance : HUF can pay life insurance premiums for its members and claim tax benefits under Section 80C. The maximum deduction allowed under this section is Rs 1.5 lakh.

- 5. Health Insurance : Under Section 80D, an individual can claim a deduction of Rs 25,000 per year on health insurance premiums for their family. An HUF can claim an additional deduction of up to Rs 25,000 on health insurance premiums paid for the family. If the individual is a senior citizen (60 years or more), the tax benefit limit increases to a maximum of Rs 50,000.

HUF Taxation Example

After his father's death, Mr. Rajesh Chopra forms an HUF with his wife, son, and daughter as members. Since Mr. Chopra had no siblings, his father's property is transferred to the HUF. This property generates an annual rent of Rs 7.5 lakhs. Mr. Rajesh Chopra also earns a salary of Rs 20 lakh. By creating an HUF, Mr. Chopra can save on taxes, as shown below.

|

Income

from various sources

|

Individual's

Return

|

HUF's

Return

|

|

Return Income of Mr. Chopra before formation of HUF

|

Income of Mr. Chopra after formation of HUF

|

Income of HUF

|

|

A) Salary

|

20,00,000

|

20,00,000

|

|

|

B) House property rent

|

7,50,00

|

-

|

7,50,000

|

|

C) Standard deduction on house property (30% of 7,50,000)

|

|

-

|

(2,25,00)

|

|

D) Income from house property (B-C)

|

5,25,000

|

-

|

5,25,000

|

|

Total

taxable income (A+D)

|

25,25,000

|

20,00,000

|

5,25,000

|

|

Section

80C

|

(1,50,000)

|

(1,50,000)

|

(1,50,000)

|

|

Net

taxable income (E-F)

|

23,75,000

|

18,50,000

|

3,75,000

|

|

Tax

payable (calculations based on Slab rates of the old regime including health

and education cess of 4%)

|

5,46,000

|

3,82,200

|

6,500

|

This tax arrangement saved Mr. Chopra Rs 1,57,300. Both the HUF and its members can claim deductions under Section 80C. Additionally, the HUF's income can be reinvested and will be taxed within the HUF.

How to Form a HUF

- 1. An HUF cannot be formed by one person; it requires a family.

- 2. An HUF can be created upon marriage and includes the husband, wife, and their children.

- 3. An HUF consists of a common ancestor and all his descendants, including their wives and unmarried daughters.

- 4. An HUF typically has assets from gifts, wills, ancestral property, or property contributed by its members.

- 5. After forming an HUF, it must be formally registered with a legal deed detailing its members and business. It also needs a PAN number and a bank account in its name.

Drawbacks of a HUF

- 1 Equal rights of members : The biggest drawback of an HUF is that all members have equal rights to the property. The property cannot be sold without everyone's agreement. New members, through birth or marriage, automatically join the HUF and get equal rights. This can make the HUF too large to manage effectively.

- 2. Partition : The biggest challenge of having an HUF is closing it down. An HUF can only be dissolved through a partition, which requires agreement from all members. During a partition, assets are distributed among members, often leading to disputes and legal complications.

- 3. HUF continues to be assessed until partition Once an HUF is created, you must file its tax returns until it is partitioned. A partition claim is made to the assessing officer, who will investigate after notifying the members. Income from partitioned property is taxed as the individual income of the member. If the member forms a new HUF with their wife and children, the income from the transferred property is taxed under the new HUF.