Summary :

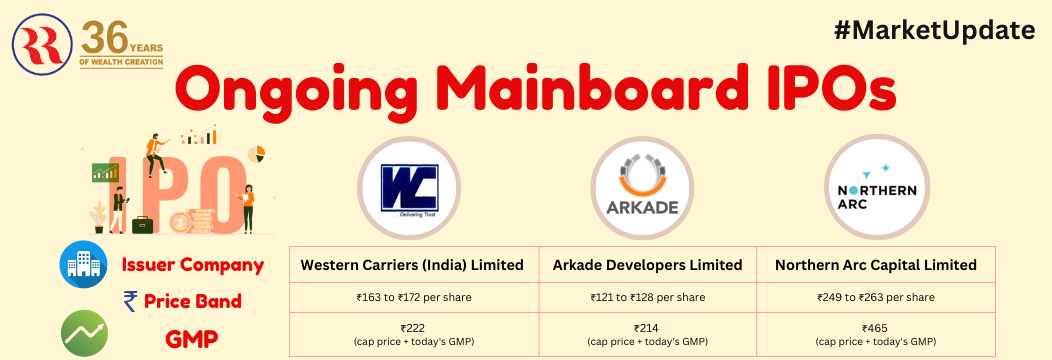

Three exciting IPOs are currently open for subscription – Western Carriers (India) Limited, Arkade Developers Limited, and Northern Arc Capital Limited. These companies, spanning logistics, real estate, and finance, offer opportunities for investors to participate in their growth. Here’s a detailed look at each IPO, including the offer size, pricing, and grey market premium (GMP) updates.

➔ IPO 1: Western Carriers (India) Limited

● Issue Size: ₹492.88 crores (₹400 crores as fresh issue, ₹92.88 crores as an offer for sale)

● IPO Open/Close Dates: September 13, 2024 – September 19, 2024

● Price Band: ₹163 – ₹172 per share

● Lot Size: 87 shares

● Listing Date: Tentative listing on September 24, 2024

● Stock Exchange: BSE, NSE

About the Company:

Western Carriers (India) Limited is a logistics company that focuses on rail-based, multi-modal transportation solutions. Its client base includes leading companies like Tata Steel, Hindalco, Cipla, and JSW. The firm specializes in combining rail and road transport using an asset-light business model and offers a range of value-added services.

IPO GMP :

As of September 18, 2024, the GMP for Western Carriers IPO is ₹50, which suggests an estimated listing price of ₹222 per share, with an expected gain of 29.07%.

**The GMP prices shown here are only news related to the grey market. We do not trade/deal in grey markets or are subject to rates (sub2), nor do we recommend trading in grey markets.

➔ IPO 2: Arkade Developers Limited

IPO Details :

● Issue Size: ₹410 crores (entirely a fresh issue)

● IPO Open/Close Dates: September 16, 2024 – September 19, 2024

● Price Band: ₹121 – ₹128 per share

● Lot Size: 110 shares

● Listing Date: Tentative listing on September 24, 2024

● Stock Exchange: BSE, NSE

About the Company:

Arkade Developers is a real estate company based in Mumbai that specializes in luxury residential projects and the redevelopment of existing properties. Over the years, the company has completed numerous projects and continues to expand in Maharashtra's property market. Arkade has developed over 2.20 million square feet of residential properties.

IPO GMP:

The latest GMP for Arkade Developers IPO is ₹86, suggesting a potential listing price of ₹214 per share, with an estimated gain of 67.19%.

**The GMP prices shown here are only news related to the grey market. We do not trade/deal in grey markets or are subject to rates (sub2), nor do we recommend trading in grey markets.

➔ IPO 3: Northern Arc Capital Limited

IPO Details:

● Issue Size: ₹777 crores (₹500 crores as fresh issue, ₹277 crores as an offer for sale)

● IPO Open/Close Dates: September 16, 2024 – September 19, 2024

● Price Band: ₹249 – ₹263 per share

● Lot Size: 57 shares

● Listing Date: Tentative listing on September 24, 2024

● Stock Exchange: BSE, NSE

About the Company:

Northern Arc Capital is a financial services company that focuses on lending to underserved markets across India. The company provides retail loans to small businesses, individuals, and rural areas through various products. Its expertise spans sectors like MSMEs, microfinance, and affordable housing finance.

IPO GMP:

As of September 18, 2024, Northern Arc Capital's GMP is ₹202, indicating an expected listing price of ₹465 per share, with a potential gain of 76.81%.

**The GMP prices shown here are only news related to the grey market. We do not trade/deal in grey markets or are subject to rates (sub2), nor do we recommend trading in grey markets.

Conclusion :

The three upcoming IPOs offer diverse opportunities for investors across the logistics, real estate, and finance sectors. With promising GMP trends, they have the potential to deliver significant returns upon listing. However, as always, investors should carefully consider their financial goals and risk tolerance before investing.

About RR Finance

An integrated financial services group, offering a wide range of financial products and services to corporations, institutions, high-net-worth individuals, and retail investors

Explore a wide range of investment opportunities with RR Finance : https://www.rrfinance.com/

Disclaimer - Investment in Initial Public Offerings (IPOs) is subject to market risks. Read all documents carefully before investing.