Summary :

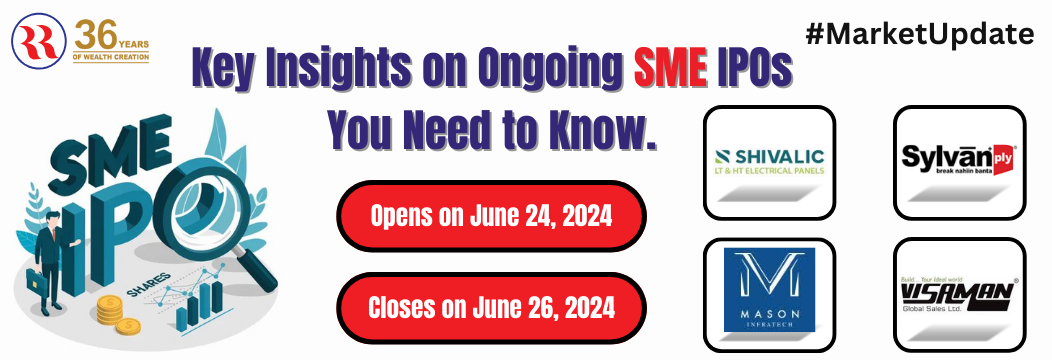

The SME IPO market is currently vibrant, with four notable companies—Shivalic Power Control Limited, Sylvan Plyboard (India) Ltd, Mason Infratech Limited, and Visaman Global Sales Limited—launching their initial public offerings. These companies are offering fresh shares to raise capital for various business objectives, ranging from working capital requirements to expansion projects. Here's a closer look at each of these SME IPOs.

Shivalic Power Control IPO:

➔ Details:

- ● Issue Size: ₹64.32 crores

- ● Price Band: ₹95 to ₹100 per share

- ● Lot Size: 1200 shares

- ● Subscription Period: June 24 to June 26, 2024

- ● Listing Date: July 1, 2024 (tentative)

- ● Lead Manager: Corporate Capitalventures Pvt Ltd

➔ About the Company:

Founded in 2004, Shivalic Power Control Limited specializes in manufacturing electric panels, including PCC, IMCC, and VFD panels. The company serves various industrial sectors in India and abroad, with a presence in countries like Nepal, Bangladesh, Uganda, Kenya, Nigeria, and Algeria.

About RR Finance

An integrated financial services group, offering a wide range of financial products and services to corporates, institutions, high-net worth individuals and retail investors.

➔ Objective:

The IPO proceeds will be used for working capital, capital expenditure, new machinery procurement, warehouse construction, and potential acquisitions.

Sylvan Plyboard IPO:

➔ Details:

- ● Issue Size: ₹28.05 crores

- ● Price: ₹55 per share

- ● Lot Size: 2000 shares

- ● Subscription Period: June 24 to June 26, 2024

- ● Listing Date: July 1, 2024 (tentative)

- ● Lead Manager: Finshore Management Services Limited

➔ Objective:

Incorporated in 2002, Sylvan Plyboard (India) Ltd manufactures plywood, block boards, flush doors, veneer, and sawn timber. The company has a network of 223 authorized dealers across 13 states in India.

➔ About the Company:

The funds will be used for purchasing additional plant and machinery, meeting working capital requirements, covering issue expenses, and general corporate purposes.

Mason Infratech IPO:

➔ Details:

- ● Issue Size: ₹30.46 crores

- ● Price Band: ₹62 to ₹64 per share

- ● Lot Size: 2000 shares

- ● Subscription Period: June 24 to June 26, 2024

- ● Listing Date: July 1, 2024 (tentative)

- ● Lead Manager: Expert Global Consultants Private Limited

➔ About the Company:

Founded in 2020, Mason Infratech Limited is a real estate construction company based in the Mumbai Metropolitan Area. It provides comprehensive construction services for residential and commercial buildings and has received accolades for its rapid growth.

➔ Objective:

The IPO aims to fund working capital requirements and general corporate purposes.

Visaman Global Sales IPO:

➔ Details:

- ● Issue Size: ₹16.05 crores

- ● Price: ₹43 per share

- ● Lot Size: 3000 shares

- ● Subscription Period: June 24 to June 26, 2024

- ● Listing Date: July 1, 2024 (tentative)

- ● Lead Manager: Shreni Shares Limited

➔ About the Company:

Incorporated in 2019, Visaman Global Sales Limited deals in a wide range of steel and pipe products. The company holds ISO 9001:2015 certification and operates stockyards and warehouses in Gujarat and Madhya Pradesh.

➔ Objective:

The raised capital will be used to set up a manufacturing facility in Rajkot, Gujarat, fund working capital requirements, and for general corporate purposes.

Conclusion:

These four SME IPOs present diverse investment opportunities in sectors ranging from manufacturing and construction to steel products. Investors should consider the specific objectives and financial health of each company before investing. The subscription window for all four IPOs is open from June 24 to June 26, 2024, with expected listings on July 1, 2024.

About RR Finance:

An integrated financial services group, offering a wide range of financial products and services to corporates, institutions, high-net-worth individuals, and retail investors.

Disclaimer: Investment in Initial SME Public Offerings (IPOs) is subject to market risks. Read all documents carefully before investing.