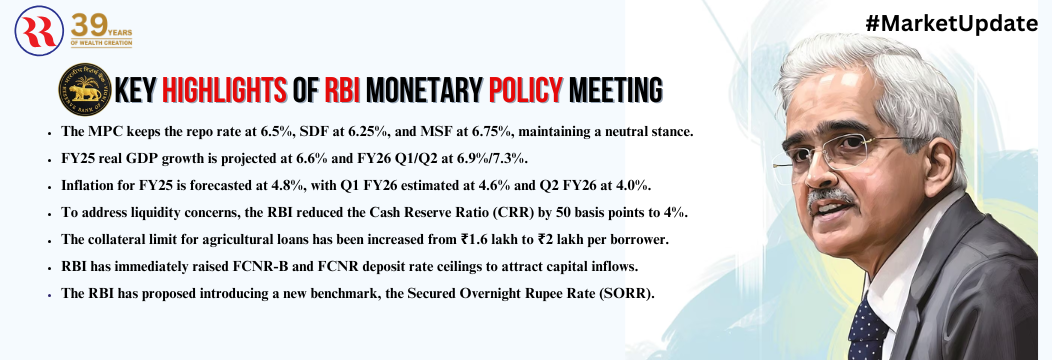

The Reserve Bank of India (RBI) announced its latest monetary policy decisions on Friday, December 6, 2024. The Monetary Policy Committee (MPC) has decided to maintain the policy repo rate at 6.50%, including the standing deposit facility at 6.25% and the marginal standing facility and Bank Rate at 6.75%.

The Monetary Policy Committee (MPC) has decided to retain a neutral monetary policy stance. This approach provides flexibility to closely monitor inflation trends and economic growth while allowing for appropriate actions to be taken when necessary.

The RBI has emphasized that although inflation is steadily decreasing, the global economy is still stable. However, trade uncertainty and geopolitical threats still have an effect on financial markets. Domestically, a slowdown in private investment and consumption was the main cause of India's GDP growth slowing to 5.4% in Q2 FY25. Despite this, the RBI expects a slow recovery supported by robust industrial development, strong agricultural output, and ongoing service activity.

Food price hikes and core inflation pressures were the main causes of headline inflation's October increase to 6.2%, which was higher than the upper target level. But thanks to good rabi crops and seasonal easing in vegetable supply, the RBI predicts a drop in food inflation in the upcoming months. With a forecast rate of 4.8% for FY25, inflation is predicted to trend lower despite these obstacles.

The MPC highlighted several key risks to the economic outlook, including geopolitical tensions, financial market volatility, and unpredictable global commodity prices. These factors contribute to ongoing inflation concerns, signifying the importance of continued vigilance and timely monetary adjustments to manage potential economic challenges.

The minutes of the MPC meeting will be published on December 20, 2024. The next MPC meeting is scheduled to take place between February 5 and February 7, 2025. These upcoming developments are expected to offer further insights into the RBI’s strategies and its outlook on the economy.

In the previous MPC meeting, held in October, the RBI decided to maintain the status quo on rates, keeping the repo rate at 6.5%, the Standing Deposit Facility (SDF) at 6.25%, and the Marginal Standing Facility (MSF) at 6.75%. The decision, supported by five out of the six members, also marked a shift to a neutral policy stance.

The statement from October underscored the need to balance inflation control with economic growth, stating, "These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4% within a band of +/- 2%, while supporting growth.

About RR Finance

An integrated financial services group, offering a wide range of financial products and services to corporations, institutions, high-net-worth individuals, and retail investors

Explore a wide range of investment opportunities with RR Finance

Disclaimer : The recommendations, suggestions, views, and opinions expressed by experts are their own and do not reflect the views of RR Finance. This news is for information purposes only, not investment advice.